Johannesburg – JSE-listed Aspen Pharmacare Holdings Limited (APN), a global multinational specialty pharmaceutical company, has reported positive unaudited interim Group financial results for the six months ended 31 December 2024.

Stephen Saad, Aspen Group Chief Executive said, “We’re pleased to have delivered positive results operationally while also executing on and advancing our strategic ambitions. The Group has delivered double digit constant exchange rate (“CER) growth in revenue and normalised EBITDA in Commercial Pharmaceuticals coupled with strong growth in FDF Manufacturing supported by the growing contribution from sterile manufacturing contracts. Significant progress has been made in the Group’s GPL-1 initiatives which will materially benefit both Commercial Pharmaceuticals and Manufacturing into the future.”

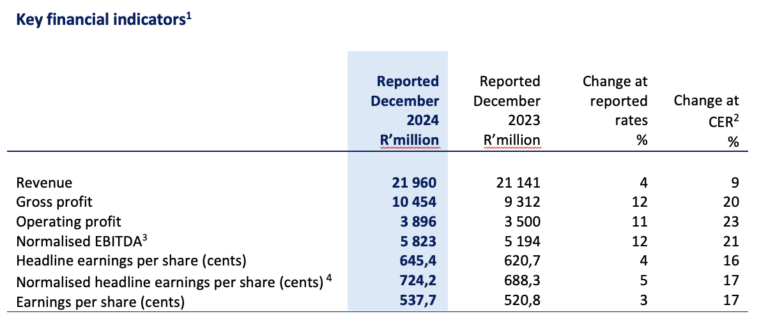

GROUP FINANCIAL HIGHLIGHTS AND ACHIEVEMENTS

- Robust CER growth in normalised EBITDA of 21% and normalised headline earnings per share of 17% underpinned by strong performances in both Commercial Pharmaceuticals and Manufacturing;

- However, the strength of the ZAR against all of Aspen’s trading currencies over the period significantly diluted reported performance compared to the underlying CER performance;

- Commercial Pharmaceuticals delivered CER growth of 13% in revenue and normalised EBITDA;

- Normalised EBITDA in the Manufacturing segment more than doubled, driven by an increased contribution from sterile contract manufacturing;

- Lilly’s Tirzepatide based product, branded as Mounjaro, was successfully launched in South Africa and will be a key contributor supporting growth in the Africa Middle East region;

- Successful integration of the products acquired in Latin America boosted revenue growth;

- Significant progress has been made in respect of the GLP-1 initiatives, representing a material opportunity for both Commercial Pharmaceuticals and Manufacturing; and

- Earnings growth has been reduced by a rise in the effective tax rate, primarily due to South Africa’s implementation of the Organisation for Economic Co-Operation and Development rules on a global minimum tax rate of 15% (“BEPS Pillar 2”).

1 The Group assesses its operational performance using constant exchange rates (“CER”). The table above compares performance to the prior comparable period at reported exchange rates and at CER.

2 The CER percentage change is based upon the performance for the six months ended 31 December 2023 recalculated using the average exchange rates for the six months ended 31 December 2024.

3 Operating profit before depreciation and amortisation adjusted for specific non-trading items as defined in the Group’s accounting policy.

4 Normalised headline earnings per share (“NHEPS”) is headline earnings per share (“HEPS”) adjusted for specific non-trading items as defined in the Group’s accounting policy.

GROUP PERFORMANCE

The Group has delivered positive half year results thanks to strong performances across all segments of the business. Group revenue for the six months ended 31 December 2024 grew 4% (9% CER) with gross profit rising well ahead of revenue at 12% (20% CER), influenced by a higher proportion of sales in Commercial Pharmaceuticals and improved profitability in Manufacturing. Normalised EBITDA was up 12% (21% CER) to R5 823 million mirrored closely by operating profit which rose 11% (23% CER).

Normalised net financing costs of R681 million increased by 20%, impacted by the carry-over effect of higher relative interest rates and increased net debt levels. Higher tax expenses, impacted by regional profit mix and the recent introduction of BEPS Pillar 2 in South Africa, diluted NHEPS growth to 5% (17% CER) with NHEPS of 724 cents. HEPS grew by 4% (16% CER) and earnings per share ended 3% higher (17% CER), affected by higher restructuring costs and intangible asset impairments respectively.

Higher working capital investment in Manufacturing inventory, largely seasonal, weighed on H1 2025 operating cash flows. The higher inventory investment has reduced the operating cash conversion rate to 63% (H1 2024: 89%). Net debt has increased from R26,9 billion to R30,0 billion in the six months to December 2024 with the leverage ratio of 2,5x remaining comfortably within the Group’s targeted range.

SEGMENTAL PERFORMANCE

Commercial Pharmaceuticals

Solid revenue growth of 7% (13% CER) to R16 102 million was augmented by the product portfolio acquisition in Latin America and supported by underlying organic CER growth in all three segments. Gross profit margins remained robust at 59,1% (H1 2024: 59,8%). Normalised EBITDA was up 13% in CER and well aligned to the revenue growth, despite absorbing proportionately higher operating expenses in the business acquired from Sandoz in China.

Prescription

Prescription Brands, the largest segment within Commercial Pharmaceuticals, enjoyed double digit growth of 19% (25% CER), recording revenue of R6 340 million. Americas, which benefitted from the added contribution from the acquired products, led the growth, followed by Africa Middle East boosted by the Lilly portfolio. Gross profit percentage of 61,0% (H1 2024: 61,6%) was supported by a favourable sales mix from Americas.

OTC

OTC revenue declined by 3% (+2% CER) to R4 743 million, impacted by order delays in Africa Middle East, but is expected to rebalance in H2 2025. Excluding Africa Middle East, the other regions enjoyed solid CER growth of 6% for the period. The Australasia OTC portfolio has, for the first time, delivered revenue equal to the region’s Prescription segment and is well positioned for future growth. Gross profit percentage of 58,4% was closely aligned to the prior period (H1 2024: 58,8%).

Injectables

The Injectables portfolio has returned to growth in H1 2025, rising 4% (10% CER) to R5 019 million. Africa Middle East growth was fuelled by the Lilly products including the successful launch of Mounjaro in South Africa during December 2024. The recent product swop transaction with Sandoz impacted Asia positively and Europe negatively, while providing a strong net benefit to Injectables growth. Gross profit percentage declined to 57,5% (H1 2024: 58,9%) influenced by the impact of national volume-based procurement (“VBP”) in China.

Manufacturing

Manufacturing revenue of R5 858 million ended 4% lower (0% CER) with growth in FDF revenue offsetting declines in the Heparin and API businesses. FDF revenue was up 59% supported by the growing contribution from sterile manufacturing contracts. The Heparin revenue reduction was anticipated as the business benefitted from the transition to a working capital light toll model in the prior year. API revenue declined by 21% to R1 888 million impacted by order phasing with a strong recovery expected in H2 2025. Gross profit percentage of 15,9% (H1 2024: 5,3%) benefitted from the higher FDF contribution with a more than twofold increase in normalised EBITDA over the prior period.

PROSPECTS

The Group has made positive progress during the reporting period and is well positioned to deliver on its strategic ambitions.

The negative effects of VBP in China and the reduction in Russia CIS sales are out of the Commercial Pharmaceuticals base, clearing the business of material risk. We anticipate double digit CER revenue and normalised EBITDA growth from Commercial Pharmaceuticals for the full year, underpinned by organic growth in all three segments and benefitting from the acquired portfolio in Latam and the exciting rollout of Mounjaro in South Africa. Following Aspen’s acquisition of Sandoz’s business in China, that business will be reshaped in H2 2025 to ensure it has the capacity and flexibility to meet future opportunities and challenges.

Positive progress has been made towards commercialisation of the Novo insulin manufacturing contract with the final technical milestones expected to be completed in Q4 2025. We expect Manufacturing to continue to deliver robust growth in H2 2025 supported by a sustained strong contribution from sterile manufacturing contracts in FDF and a seasonal second half weighted rebound from the API business. The absolute growth in CER normalised EBITDA from Manufacturing in H2 2025 is anticipated to be similar to the growth achieved in H1 2025.

Localisation preferences are anticipated to be legislated in Q2 CY 2025 which will ensure that all South African dossier registrations for locally manufactured products receive priority review from SAHPRA. The regulatory pathway timelines for the Serum paediatric vaccines will benefit as a result with potential commercial sales from calendar year 2026. Aspen remains committed to achieving incremental CER EBITDA growth from sterile capacity fill initiatives in FDF of R2 450 million over the period FY 2025 to FY 2026 (compared to FY 2024).

GLP-1s, sterile injectable products for the treatment of type 2 diabetes and obesity, represents the largest opportunity currently present in the global pharmaceutical industry. During the past period Aspen has made significant progress in positioning itself as an owner of the intellectual property associated with generic semaglutides (a class of GLP-1s), as a manufacturer of the injectable dosage form of the medication and in establishing the appropriate marketing and distribution reach in time for launch of these products in the market. The first revenue generated by Aspen from its GLP-1 initiatives could be as early as the latter part of FY 2026.

Manufacturing inventory levels are expected to reduce in H2 2025 following the seasonal growth in the first half. This reduction coupled with a cyclically stronger operating cash flow in the second half, should assist the Group in achieving an operating cash conversion rate greater than our target of 100% at year end. Finance costs are anticipated to benefit from lower effective interest rates in H2 2025 driven by the recent interest rate cuts across our EUR, ZAR and AUD debt pools. We anticipate that effective tax rates will be higher from FY 2025 onwards, impacted by the increased profit contribution from sterile manufacturing as well the retrospective introduction of the BEPS Pillar 2 legislation in South Africa.

Any forecast information in the above-mentioned paragraphs has not been reviewed or reported on by the Group’s auditors and is the responsibility of the directors.

The contents of the short form announcement are the responsibility of the Board of directors of Aspen. The information in the short form announcement is a summary of the full announcement.

The full announcement is available on Aspen’s website https://www.aspenpharma.com/investor-relations/#financial-results-and-presentations and can also be accessed online at https://senspdf.jse.co.za/documents/2025/jse/isse/APN/HYresults.pdf. Any investment decision must be based on the information contained in the full announcement.