Aspen will be in a closed period from 1 January 2025 until the publication of the Interim Results on the JSE SENS platform on 3 March 2025.

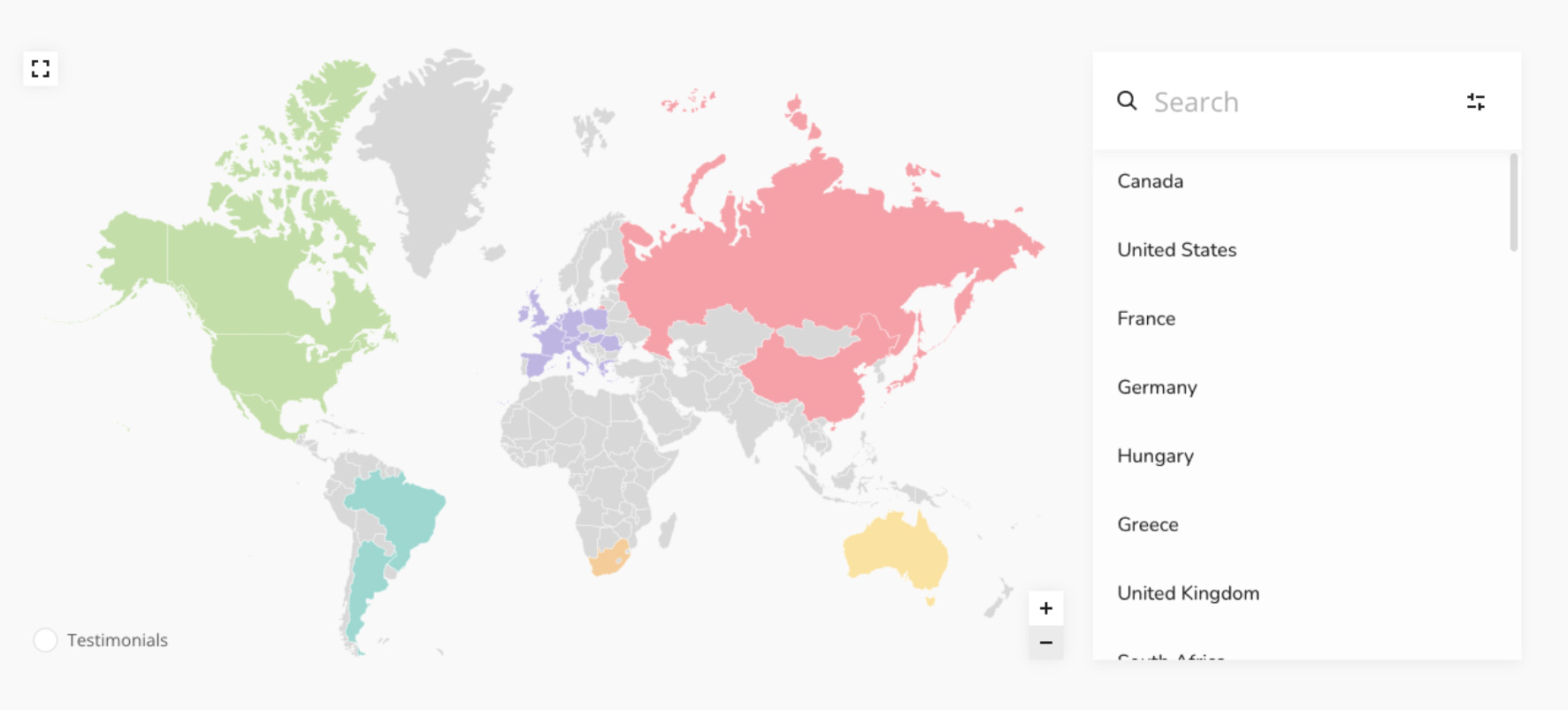

With a 170-year heritage, Aspen is a global specialty and branded multinational pharmaceutical company with a presence in both emerging and developed markets. We have more than 9 300 employees at 63 established offices in over some 46 countries and territories and we improve the health of patients in more than 115 countries through our high quality, affordable medicines.

Aspen focuses on marketing and manufacturing a broad range of post-patent, branded medicines and domestic brands covering both hospital and consumer markets through our key business segments. Our key business segments are Manufacturing and Commercial Pharmaceuticals comprising Injectable products, Prescription and OTC medicines. Our manufacturing capabilities cover a wide variety of product types including steriles, oral solid dose, liquids, semi-solids, biologicals and active pharmaceutical ingredients.

We operate 24 manufacturing facilities across 15 sites and we hold international manufacturing approvals from some of the most stringent global regulatory agencies including, among others, the United States Food and Drug Administration, the Australian Therapeutic Goods Administration and the European Directorate for the Quality of Medicines.

Group Chief Executive

Qualifications:

Appointed:

Classification:

CA(SA), PhD (Commerce) Honoris Causa

January 1999

Executive director

Stephen is a founding shareholder of the Aspen Group and his responsibilities include strategic positioning and global transactions, geographic expansion and product diversification of Aspen in developed and emerging markets as a leading multinational pharmaceutical company. He was further awarded with the Chevalier de l’Ordre national du Merite (Knight of the French National Order of Merit) which was bestowed on him in March 2020.

Group Chief Financial Officer

Qualifications:

Appointed:

Classification:

CA(SA), Advanced Taxation Certificate (UNISA)

January 2022

Executive director

Sean is responsible for all the Group’s finance functions across Aspen’s businesses. He also assesses business performance and identifies business improvement opportunities.

Qualifications:

Appointed:

Classification:

MPhil (Oxon), BSocSci (Hons) (Natal), Global Leadership for the 21st Century Programme (Harvard), Foundations for Leadership in the 21st Century (Yale)

April 2012

Independent non-executive, Chair

Kuseni was previously Chair of Massmart Holdings Limited, Times Media Group Limited and Chief Executive Officer of Old Mutual South Africa and Emerging Markets. He brings a wealth of economic and business skills to the Board, having previously held positions as the head of Anglo American South Africa and Executive Chairman of Richards Bay Coal Terminal Company.

Kuseni is the former Chair of the South African National Parks and a former member of the Global Agenda Council on Economic Growth and Poverty Alleviation formed by the World Economic Forum. He is active in academic and professional bodies, which include being the former Chair of the Council of the University of Pretoria, Deputy Chair of the South African Institute of International Affairs, and Chair of the advisory board of the Gordon Institute of Business Science (GIBS).

Kuseni is a member of the Remuneration & Nomination Committee and the Social & Ethics Committee.

Qualifications:

Appointed:

Classification:

CA(SA), MCom (Tax), CD(SA)

July 2018

Independent non-executive

Linda has served as an independent non-executive director on a number of JSE listed boards since 2010 and is currently on, Momentum Group and Momentum Metropolitan Life Limited and Shoprite Holdings Limited. In addition, Chairs the board of trustees of the International Public Interest Oversight Board (PIOB), a non-profit foundation in Spain which oversees the work of the two international audit and ethics standards boards, and serves as a trustee of the International Valuations Standards Council (based in London).

Linda serves as the Chair of the Remuneration & Nomination Committee and is a member of the Audit & Risk Committee.

Qualifications:

Appointed:

Classification:

CA(SA), B.Com (Hons), MCom

March 2024

Independent non-executive

Mrs Dongwana is a Chartered Accountant with B.Com and B.Com Honours (Financial Analysis and Portfolio Management) degrees from the University of Cape Town. She also has a Masters in Commerce from the University of the Witwatersrand.

After serving her articles and qualifying as a chartered accountant at Deloitte, Neo spent her early career as an equity analyst at Gensec Asset Management before rejoining Deloitte, where she held the position of audit partner for almost 9 years. She is currently a non-executive director on the board of Nedbank Limited.

A previous Chair of Barloworld Limited and the Takeover Regulation Panel, Neo has previously served on various listed and unlisted boards across various industries and jurisdictions. She previously was a member of the education committee of the Independent Regulatory Board of Auditors (IRBA) and was a member of the Financial Services Tribunal.

Neo serves as a member of the Audit & Risk Committee.

Qualifications:

Appointed:

Classification:

MBA, PGDBA, ND, NHD, Graduate Diploma in Company Direction

March 2024

Executive director

Reginald leads Aspen’s Group enablement, shared services, governance functions, including technology, people, and strategic business processes. He also oversees the Group’s organisational design, operating model, and business performance.

He is an independent non-executive director on the boards of SASRIA SOC and IoDSA.

He joined the Social & Ethics Committee in September 2020 and was appointed Executive Director in March 2024

Reginald serves as a member of the Social & Ethics Committee.

Qualifications:

Appointed:

Classification:

BCom (Hons), CA(SA), Advanced Programme in Management (Harvard Business School)

April 2019

Lead independent non-executive

Ben joined Standard Corporate and Merchant Bank in 1985, and having fulfilled various leadership roles, was appointed Chief Executive of Corporate and Investment Banking in 2000. In March 2013 Ben was appointed as Chief Executive of the Standard Bank Group Limited, and retired from this position at end of 2018. He currently serves on the Johannesburg Stock Exchange, the Standard Bank Group and Standard Bank of South Africa Boards. He is a Council member for Leadership for Conservation in Africa, and serves as Deputy Chair, and he is a member of the Council for the University of Pretoria.

Ben is Chair of the Audit & Risk Committee and a member of the Social & Ethics Committee.

Qualifications:

Appointed:

Classification:

B.Eng (Hons)

April 2019

Independent non-executive

Themba was appointed as the Regional Director Africa and Australia Anglo American Plc Group , in January 2022. Prior to this appointment, he held several senior executive positions at various companies, including Anglo American Plc, Kumba Iron ore, Anglo American Coal South Africa, Rio Tinto Technology and Innovation Americas, Rio Tinto Coal Australia , Richard’s Bay Minerals and Huntsman Tioxide Southern Africa.

Themba is a member of the Remuneration & Nomination Committee.

Qualifications:

Appointed:

Classification:

BA, LLB

January 1999

Non-executive

Chris has been a full-time practising attorney since 1988 and has substantial legal and commercial expertise. His intimate knowledge of the Group, its business operations and governance processes have been of immense benefit to Aspen over the years and he continues to serve the Board as a trusted adviser. As Chris’s firm is intermittently called upon to provide legal advice to the Group, he is classified as a non-independent non-executive director.

Qualifications:

Appointed:

Classification:

D.Phil (Oxon), MA, BA (Hons), Leadership Financial Organizations, Harvard Business School

December 2021

Independent non-executive

Yvonne currently serves as Chairperson of the Rhodes Food Group, and Chair of Mavovo Capital, as well as an independent non-executive director on the boards of the SA Reserve Bank and the SA SME Fund. She was also Chair of Bankserv and Chair of the Sasol Foundation, and non-executive director of Thebe Investment Corporation. Yvonne previously served as Chief Executive: Group Services at Sanlam and executive director of Sanlam Ltd as well as non-executive director of Santam, Sanlam Investments and Sanlam Investment Management. Preceding that she was Vice President of Coca-Cola Africa in London and Group Executive at the MTN Group Ltd. She also formerly served as a non-executive director for Aurecon, Sentech, MTN Nigeria, the SABC, and Transnet. Yvonne previously served as Chief Executive: Group Services at Sanlam and Executive Director of Sanlam Ltd as well as non-executive director of Santam, Sanlam Investments and Sanlam Investment Management. Preceding that she was Vice President for Coca-Cola Africa based in London and Group Executive for the MTN Group Ltd. She also formerly served as a non-executive director for Aurecon, Sentech, MTN Nigeria, the SABC, and Transnet.

Qualifications:

Appointed:

Classification:

BSc (Hons), CA

February 2015

Non-executive * British

David was appointed President Corporate Development of GSK in May 2008 and is responsible for business development and strategic planning. He has, in this role, assisted GSK in numerous bolt-on acquisitions, disposals and joint ventures, including the creation of the world-leading Consumer Healthcare company, now called Haleon plc, through the combination of the GSK consumer healthcare business firstly with Novartis’s business and subsequently in 2019 with Pfizer’s business. He is a member of GSK’s Corporate Executive Team and reports to the CEO. Prior to holding this position, he was responsible for the leadership of GSK’s business in Northern Europe from 2005 to 2008 and Central and Eastern Europe from 2002 to 2005. He joined Glaxo in 1994 in finance and progressed through a series of finance roles before becoming Finance Director of the European business in 1999.

In addition to his current role, David is Chair of ViiV Healthcare Limited. ViiV is a joint venture between GSK, Pfizer and Shionogi and focuses specifically on the research and development and global commercialisation of medicines to treat HIV.

Qualifications:

Appointed:

Classification:

LLB

January 2024

Group Company Secretary

Raeesa Khan, in her capacity as Group Company Secretary, will take on governance oversight responsibility and the link between the Group Executive Committee and Aspen’s Board of Directors.

Qualifications:

Appointed:

Classification:

CA(SA), PhD (Commerce) Honoris Causa

January 1999

Group Chief Executive

Stephen is a founding shareholder of the Aspen Group, and his responsibilities include strategic positioning and global transactions, geographic expansion and product diversification of Aspen in developed and emerging markets as a leading multinational pharmaceutical company.

Qualifications:

Appointed:

Classification:

CA(SA)

January 1999

Group Chief Advisor

Gus is a founding shareholder of Aspen and is responsible for providing insight and advice on strategic matters.

Qualifications:

Appointed:

Classification:

CA(SA), Advanced Taxation Certificate (UNISA)

January 1999

Group Chief Financial Officer

Sean is responsible for the strategic and financial well-being of the Group and for all the Group’s finance functions across Aspen’s businesses.

Qualifications:

Appointed:

Classification:

BPharm

April 2021

Group Chief Operations Officer

Lorraine is responsible for multiple operational areas of the business, including strategic manufacturing, pharmaceutical affairs, new product development and strategic procurement.

Qualifications:

Appointed:

Classification:

MBA, PGDBA, ND, NHD, Graduate Diploma in Company Direction

April 2021

Group Chief Corporate Officer

Reginald leads Aspen’s Group enablement, shared services, and governance functions, including technology, people, and strategic business processes.

He joined the Social & Ethics Committee in September 2020 and was appointed as Executive director in March 2024.

Qualifications:

Appointed:

Classification:

CA(SA), CFA, LLB

April 2021

Group Chief Strategic Development

Zizipho is responsible for focusing primarily on Group commercial pharmaceutical deal origination.

Qualifications:

Appointed:

Classification:

CMA, CFM, CBM, MBA

April

Aspen Global Incorporated

Samer leads and directs international operations; oversees, implements and executes all global Commercial Pharmaceuticals transactions.

Qualifications:

Appointed:

Classification:

BSc (Hons) Forensic & Analytical Chemistry

April

Group Executive: Supply Chain

Pauline oversees international supply, quality and regulatory functions and drives Group Supply Chain standardisation, automation.

Qualifications:

Appointed:

Classification:

CA(SA)

April

Regional Chief Executive Officer, Asia Pacific

Trevor implements strategy, performance delivery and trade across the Asia Pacific Commercial Pharmaceutical businesses and leads transactional activity in the region.

Qualifications:

Appointed:

Classification:

CA(SA), ACMA, CGMA, Adv.Dip (Tax)

April

Group Executive: Finance (Manufacturing and Commercial

Chris is responsible for the overall financial management and oversight of Aspen’s commercial and manufacturing businesses and the Group’s Holdings business unit.

Qualifications:

Appointed:

Classification:

LLB

January 2024

Group Company Secretary

Raeesa Khan, in her capacity as Group Company Secretary, will take on governance oversight responsibility and the link between the Group Executive Committee and Aspen’s Board of Directors.

Qualifications:

Appointed:

Classification:

B.Pharm, FPS (SA), PhD (Medicine) Honoris Causa

April

Group Senior Executive Strategic Trade

Stavros initiates business development opportunities and is also key to the building and maintenance of strategic relations within industry and with all of Aspen’s stakeholders.

Qualifications:

Appointed:

Classification:

Bachelor of Dental Science (BDS)

October 2022

Senior Group Executive: Commercial (International Regions)

Carnie develops and implements the Commercial Pharmaceuticals strategy and performance delivery across the Group’s international regions.

Aspen Holdings

www.aspenpharma.com

Hotline (South Africa)

0800 122 912

Medical Careline (South Africa) 0800 118 088

ASPEN PHARMACARE HOLDINGS LTD:

Switchboard: +27 31 580-8600

Aspen Place

9 Rydall Vale Park

Douglas Saunders Drive

La Lucia Ridge

South Africa