Johannesburg – JSE-listed Aspen Pharmacare Holdings Limited (APN), a global multinational specialty pharmaceutical company, is pleased to report reviewed provisional Group financial results for the year ended 30 June 2022.

SALIENT FEATURES

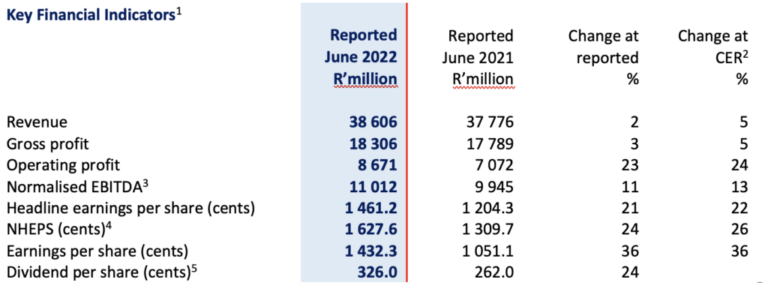

- Revenue from continuing operations increased by 2% (+5% in constant exchange rate (“CER”)) to R38,6 billion (FY2021: R37,8 billion);

- Normalised EBITDA from continuing operations increased by 11% (+13% in CER) to R11,0 billion (FY2021: R9,9 billion);

- Normalised headline earnings per share from continuing operations increased by 24% (+26% in CER) to 1 627,6 cents (FY2021: 1 309,7 cents);

- Headline earnings per share from total operations increased by 31% (+31% in CER) to 1 461,2 cents (FY2021: 1 119,1 cents);

- Earnings per share from total operations increased by 36% (+36% in CER) to 1 432,3 cents (FY2021: 1 052,9 cents);

- Dividend declared to shareholders increased by 24% to 326 cents per ordinary share (FY2021: 262 cents);

- Aspen signs 10-year agreement with the world’s largest vaccine producer, Serum Institute of India.

Stephen Saad, Aspen Group Chief Executive said, “The Group has achieved a robust set of results for the year ended 30 June 2022, supported by improved operating margins underpinned by a lower operating expense base and a strong balance sheet, all of which provide a solid foundation for future sustainable growth.”

“Aspen has concluded a 10-year collaboration agreement with Serum Institute of India Pvt. Ltd. (“the Serum Institute”) to manufacture, market and distribute four Aspen-branded routine vaccines in Africa. In responding to the COVID-19 pandemic, investing billions to establish world class steriles manufacturing capability, Aspen has demonstrated its ability to partner successfully to deliver millions of doses of vaccine to the highest standard. Through this agreement with the Serum Institute, the partners are responding to the African Union’s call for more African vaccine manufacturing on the continent. Enhancing access to medicines is at the forefront of Aspen’s ESG strategy. ”

GROUP HIGHLIGHTS (CONTINUING OPERATIONS)

1 – The Group assesses its operational performance using constant exchange rate (“CER”) and all segmental performance-related commentary is made with reference to the underlying CER trends. The table above compares performance from continuing operations to the prior comparable period at reported exchange rates and at CER.

2 – The CER % change is based upon the performance for the year ended 30 June 2021 restated using the average exchange rates for the year ended 30 June 2022.

3 – Operating profit before depreciation and amortisation adjusted for specific non-trading items as set out in the normalised headline earnings reconciliation on page 8 of Aspen’s Year End Results Booklet available at www.aspenpharma.com.

4 – Normalised headline earnings per share (“NHEPS”) represents headlines earnings per share (“HEPS”) adjusted for specific non-trading items as defined in the Group’s accounting policy.

5 – Dividend declared on 31 August 2022, to be paid on 26 September 2022 (2021: Declared on 1 September and paid 27 September 2021).

GROUP PERFORMANCE (CONTINUING OPERATIONS)

The Group has delivered a strong performance, with double digit organic growth in normalised EBITDA, operating profit and earnings. This performance is testimony to Aspen’s resilience against the backdrop of a challenging trading environment and inflationary cost pressures.

Group revenue for the financial year ended 30 June 2022 grew 2% (+5% CER) to R38 606 million with Commercial Pharmaceuticals revenue declining 1% (+1% CER) and Manufacturing revenue increasing 11% (+18% CER). Gross profit growth of 3% (+5% CER) slightly exceeded revenue growth, with the underlying segmental gross margins all showing improvement. The increased contribution from the lower margin Manufacturing segment diluted the overall gross margin percentage. Normalised EBITDA rose 11% (+13% CER) to R11 012 million, largely due to the leverage provided by lower operating expenses. NHEPS increased 24% (+26% CER) to 1627.6 cents, bolstered by reduced net financing costs. The higher percentage growth in earnings per share, relative to HEPS, is attributable to the profit on the sale of a product portfolio divested in South Africa.

Net borrowings reduced to R16,1 billion, down from the R16,3 billion reported at 30 June 2021, ensuring that the Group’s leverage ratio remained comfortably below target levels. This provided the Group with an opportunity to fund a share buy-back of R1,8 billion (2.2% of issued shares) during the year. Operating cash flow was impacted as a consequence of increased inventory investment by the Manufacturing segment in key input materials to mitigate future supply constraint risks which may arise from continued global supply chain disruptions.

SEGMENTAL PERFORMANCE (CONTINUING OPERATIONS AT CER)

Commercial Pharmaceuticals

Commercial Pharmaceuticals, comprising of Regional Brands and Sterile Focus Brands, grew 1% to R27 658 million. Solid underlying volume growth of 4% was impacted, primarily, by the divestment of certain products in South Africa, challenges faced by our Chinese business, including volume-based procurement (“VBP”) and COVID-19 (“COVID”) related lockdowns, as well as the impact of the geopolitical situation in Russia and Ukraine on our businesses there. Gross profit increased 3% to R16,1 billion, supported by improved margins in both Regional and Sterile Focus Brands, despite the inflationary and freight cost headwinds experienced, particularly in the second half of the financial year.

Regional Brands

Regional Brands revenue increased by 3% to R17 405 million, with 13% growth from Australasia and 8% from the Americas, being the major contributors. Supply constraints and product portfolio divestments impacted the performance of Africa Middle East. Gross profit percentage was up at 56.5% (FY2021: 54.6%), driven by cost of goods savings and portfolio optimisation, combined with a favourable product mix.

Sterile Focus Brands

Revenue from Sterile Focus Brands decreased 2% to R10 253 million due to lower sales in Russia CIS during the second half of the financial year and the aforementioned challenges in China. A higher gross profit percentage of 60.7% (FY2021: 60.0%) benefitted from cost of goods savings partially offset by higher logistics costs.

Manufacturing

Manufacturing revenue increased 18% to R10 948 million with significant growth in finished dose form sales. This included R1,4 billion in revenue from the fill and finish production of the Johnson & Johnson COVID vaccine at our Gqeberha sterile manufacturing facility. This growth was partly diluted by the Chemicals business. Manufacturing in general was negatively impacted by supply related constraints imposed by COVID in the first half of the year and enjoyed a strong second half recovery, growing sales by 14% compared to the first half.

Gross profit at 20.6% was consistent with the prior year, even after dilution for the annualised impact of the supply agreements related to disposal transactions at low/no margin. Excluding the impact of these disposal transaction-related supply agreements, gross margin increased in all segments. These improvements were achieved despite numerous operational and supply chain related challenges, as well as notable inflationary increases in operating and supply chain costs.

PROSPECTS

The Group has achieved a robust set of results for the year ended 30 June 2022, supported by improved operating margins, underpinned by a lower operating expense base and a strong balance sheet, all of which provide a solid foundation for future sustainable growth.

Aspen has continued to invest in the expansion of its sterile manufacturing capacity in Gqeberha to be used for vaccines and other sterile biological products. The statement from the African Union, which called for support to achieve at least a 30% offtake of all vaccines from African manufacturers is a strong endorsement supporting this ongoing strategic capital investment. The signature of a long-term agreement with the Serum Institute of India Pvt Limited for Aspen to manufacture, market and distribute four Aspen-branded vaccines in Africa is an important milestone as Aspen seeks to optimise its sterile manufacturing capacity in Gqeberha. Several other potential long-term opportunities are being explored with various multinational partners and Aspen’s ambition is to secure these by the end of the 2023 financial year. The contribution from the manufacture of the Johnson & Johnson COVID vaccine enhanced operating performance in the current year, but declining demand from Johnson & Johnson will have an unfavourable impact on Manufacturing performance in the 2023 financial year, unless substituted by orders for Aspenovax. Due to the technology transfer timelines, other sustainable long-term contracts and commercial manufacturing opportunities will only be realised from financial year 2024 onwards.

In addition to the agreement with Serum, Aspen also anticipates receiving grant funding from each of the Bill & Melinda Gates Foundation and the Coalition for Epidemic Preparedness Innovations (“CEPI”) to support African regional manufacturing capacity for an affordable supply of vaccines to, among others, African countries and Gavi/UNICEF, as well as contributing to pandemic preparedness, through a share of Aspen’s vaccine manufacturing capacity over a period of ten years. These are both important endorsements of Aspen’s sterile manufacturing capabilities and seeking to achieve enhanced access to medicines which is at the forefront of Aspen’s ESG strategy.

Aspen expects to deliver organic CER revenue growth of between 3% and 7%, (excluding potential Aspenovax orders), in the year ahead, notwithstanding the challenging trading conditions. Sales will be heavily weighted towards the second half of the year. Despite the benefit of ongoing cost of goods savings initiatives, potential lower contribution from vaccines and ongoing inflationary pressures are expected to dilute the gross margin percentage. Operating expenses are expected to continue tracking below the percentage growth in revenue. The current upward trajectory in global interest rates is, however, expected to weigh on financing costs in the 2023 financial year. Strong cash flow generation and an operating cash conversion rate above the Group target of 100% is anticipated, provided that the global supply chain landscape returns to normalised levels.

Any forecast information in the abovementioned paragraph has not been reviewed or reported on by the Group’s auditors and is the responsibility of the directors